Georgia Power’s 2025 Integrated Resource Plan (IRP) presents a pivotal opportunity to strengthen Georgia’s economic competitiveness, energy independence, and grid resilience. But as currently proposed, it misses the mark in several areas. Most notably, the utility’s modest proposal to procure just 1,000 megawatts (MW) of utility-scale renewable energy in its upcoming 2026 Request for Proposals (RFP) falls short of meeting the needs of Georgia’s fast-growing economy, major job creators, and forward-looking energy strategy.

As outlined in the Testimony filed by the Southern Renewable Energy Association (SREA) on May 2, 2025, the 2026 RFP should be revised to include at least 2,000 MW of new utility-scale renewables — a fiscally responsible and market-driven approach to securing Georgia’s energy future.

Georgia Businesses Want More Clean Energy

Across the state, Georgia’s major employers — including manufacturers, data centers, and logistics firms — are seeking more clean energy to meet customer expectations and corporate sustainability targets. As further discussed in the Testimony filed by the Clean Energy Buyer’s Association:

“Many large energy customers…have ambitious sustainability and clean energy commitments that require them to reduce the carbon emissions profile of their electricity consumption. Many of these large energy customers now consider, if now prioritize, their ability to access clean energy when determining where to locate new facilities and which existing facilities to expand.” -CEBA witnesses Priya Barua and R. Brent Alderfer

These are voluntary market choices made by businesses operating in competitive environments. Yet, Georgia Power’s current planning falls short of supporting this demand. That puts Georgia at a disadvantage compared to neighboring states competing for new investment and job creation, particularly since, as CEBA further notes in their Testimony, customers in Georgia do not have access to retail choice or organized wholesale markets and “are therefore more restricted in the ways in which they can procure clean energy.”

Simply put, the market is sending clear signals. Georgia Power’s IRP should respond with a supply plan that helps the state compete, attract investment, and maintain its reputation as a top state for business.

SREA’s Modeling: More Renewables, Lower Costs, Greater Resilience

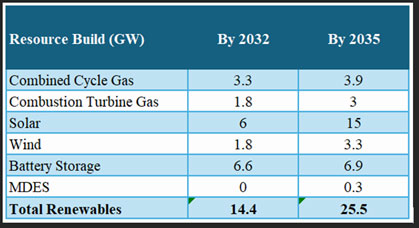

SREA and Grid Lab commissioned independent analysis of alternative resource portfolios, including portfolios with up to 14.4 GW of renewables by 2032, and 25.5 GW of renewables by 2035.

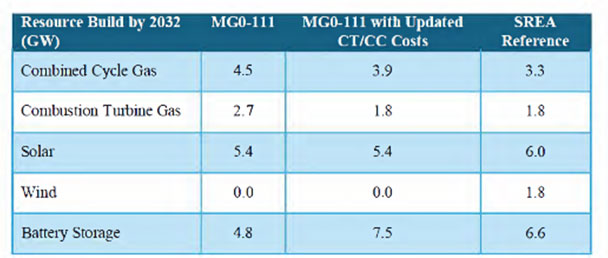

Summary of cumulative near-term builds for SREA modeled scenarios:

Cumulative resource builds in the SREA Reference Scenario:

The findings are clear: portfolios with more renewables (including solar, wind, and battery storage resources) deliver superior results on cost, reliability, and emissions — without requiring mandates or subsidies. This is particularly true at a time when gas-fired generators are facing rising costs and procurement delays, as further discussed in SREA’s Testimony.

“Recent national studies and regulatory proceedings across the Southeast have underscored challenges in the procurement of combustion turbines, including prolonged order delays and sharp cost increases. The Company is aware of these procurement challenges and resulting costs. These dynamics underscore the urgency of proactive planning and diversified resource strategies.” -SREA witness Alejandro Palomino, Energy Strategies

Further, Georgia Public Service Commission’s Public Interest Advocacy Staff filed Testimony recommending that Georgia Power should reduce the capacity accreditation of thermal generators to account for correlated outages during winter weather events.

Georgia can strengthen its energy independence and economic competitiveness by letting low-cost renewables compete on a level playing field. But Georgia Power did not include these options in its IRP. Instead, the Company used flawed modeling that capped renewables and biased outcomes in favor of traditional resources.

Flawed Modeling Creates an Incomplete Picture

SREA’s testimony identified key problems with Georgia Power’s resource planning process:

- Capped Renewables: Arbitrary limits on clean energy additions — even when they’re the lowest-cost option.

- Inconsistent Assumptions: Economic models and reliability models use different baselines, often favoring fossil fuels.

- Lack of Transparent Comparison: Georgia Power’s proposal does not fairly test the best-performing portfolios available to customers.

- Lack of robust (multi-scenario, multi-benefit) long-term transmission planning that adequately meaningfully engages stakeholders and considers extreme weather risks.

By excluding reasonable and cost-effective options, the IRP undermines free-market principles and deprives policymakers of the full picture.

Transmission Is the Backbone of Grid Reliability and Economic Growth

Transmission infrastructure is essential to unlocking the full value of new renewable energy resources. Without adequate, long-term (minimum 20 years) transmission planning and investment, even the most cost-effective projects may be stranded — unable to deliver power where it's needed. SPP, by way of example, requires that the financial benefits of new transmission lines be evaluated over a 40 year horizon and consider multiple benefit metrics.

“Increased investment in regional transmission can improve reliability and support future load growth, provided it is properly planned in accordance with the transmission best practices recommended herein.” -SREA witness Alejandro Palomino

SREA encourages the Commission to prioritize proactive transmission development that anticipates future load growth and supports geographically diverse renewable energy generation. Forward-looking transmission planning will not only reduce long-term costs but also help Georgia avoid reliability risks and strengthen its position as a regional energy hub. The Commission’s PIA Staff witness concluded that “Georgia Power can plan a more risk-averse transmission system by conducting generation and transmission planning for scenarios and sensitivities with high renewable and high load growth.”

SREA’s Recommendations to the Georgia Public Service Commission

To ensure Georgia’s energy future is secure, affordable, and aligned with customer needs, SREA recommends the Commission:

- Increase the 2026 renewable RFP to at least 2,000 MW;

- Direct Georgia Power to add a 2 GW storage RFP in 2026 for projects with commercial operation dates of 2032 or sooner;

- Direct Georgia Power to evaluate higher-performing portfolios with up to 14.1 GW or renewables by 2032, and 25.5 MW of renewables by 2035;

- Require consistent and transparent modeling that lets market forces work;

- Recognize the real demand for renewables from Georgia job creators and industrial customers; and

- Support strategic long-term transmission planning to deliver reliable, low-cost power to growing demand centers through a process that meaningfully engages stakeholders (e.g., a transmission advisory group).

Georgia's Energy Policy Should Be Pro-Growth and Customer Centered

This IRP isn’t about ideology — it’s about smart planning and helping customers meet their aggressive clean energy goals. Georgia is already a clean energy success story, with job growth and private investment to show for it. But to stay ahead, the Commission must ensure our utilities are responsive to market demand and aligned with long-term economic interests.

At SREA, we believe Georgia’s path forward is grounded in competition, transparency, reliability, and economic growth. That path starts with bold, practical decisions in this IRP.

This is an opportunity for Georgia to lead — not just in clean energy, but in pro-business, pro-growth energy planning. The benefits are clear. The solutions are available. It’s time to act.