On August 26, the Midcontinent Independent System Operator (MISO) released preliminary results from its first Expedited Resource Addition Study (ERAS) cycle, approved by FERC on June 21. The program allows MISO to run a limited number of fast-tracked interconnection studies - 10 per cycle, up to 68 total - to meet surging demand from new “spot loads” like data centers. Projects are accepted first-come, first-served, with excess submissions rolled into later cycles.

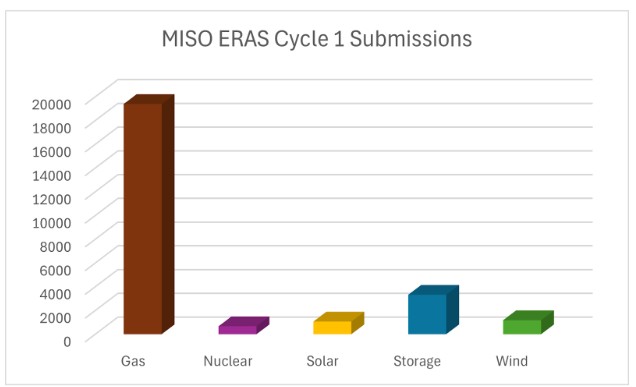

For the August 11 deadline, developers submitted 45 projects. Of these, 75% were natural gas, 12% storage, 4% solar, 4% wind, and 2% nuclear (likely an uprate).

Within 26 seconds of the August 6 opening, roughly 5GW of gas generation was filed. Half of that was in Louisiana.

Data Source: MISO ERAS Submission Tracking Data

SREA has warned that ERAS risks diverting staff time and resources from MISO’s already backlogged interconnection queue. Days before posting ERAS results, MISO announced delays to its 2023 queue cycle, now set to begin September 30. Many renewable projects that have waited years—and paid financial commitments—must now sit behind ERAS projects filed in seconds.

While ERAS speeds interconnection agreements, it doesn’t guarantee faster generation. Projects must be online within three years of signing but may request extensions up to six. With global queues straining supply chains for gas turbines, this creates a reliability challenge. In practice, gas developers, while waiting for backlogged turbines, could hold onto grid capacity granted in interconnection agreements without delivering power, while renewables capable of quicker builds remain stuck in the queue.

MISO clearly faces growing reliability needs. Yet early results show ERAS functioning less as a reliability tool and more as a shortcut for utilities to secure new gas plants—resources that struggle to compete with renewables and storage on cost and deployment speed.