When the Southeast Energy Exchange Market (SEEM) began operations on November 9, 2022, it was heralded by utilities as a flexible, low-cost solution to modernize the power grid without the “bureaucracy” of belonging to a Regional Transmission Organization (RTO). We’re three birthdays in, however, and the data is telling us a very different story.

A Quick History of SEEM

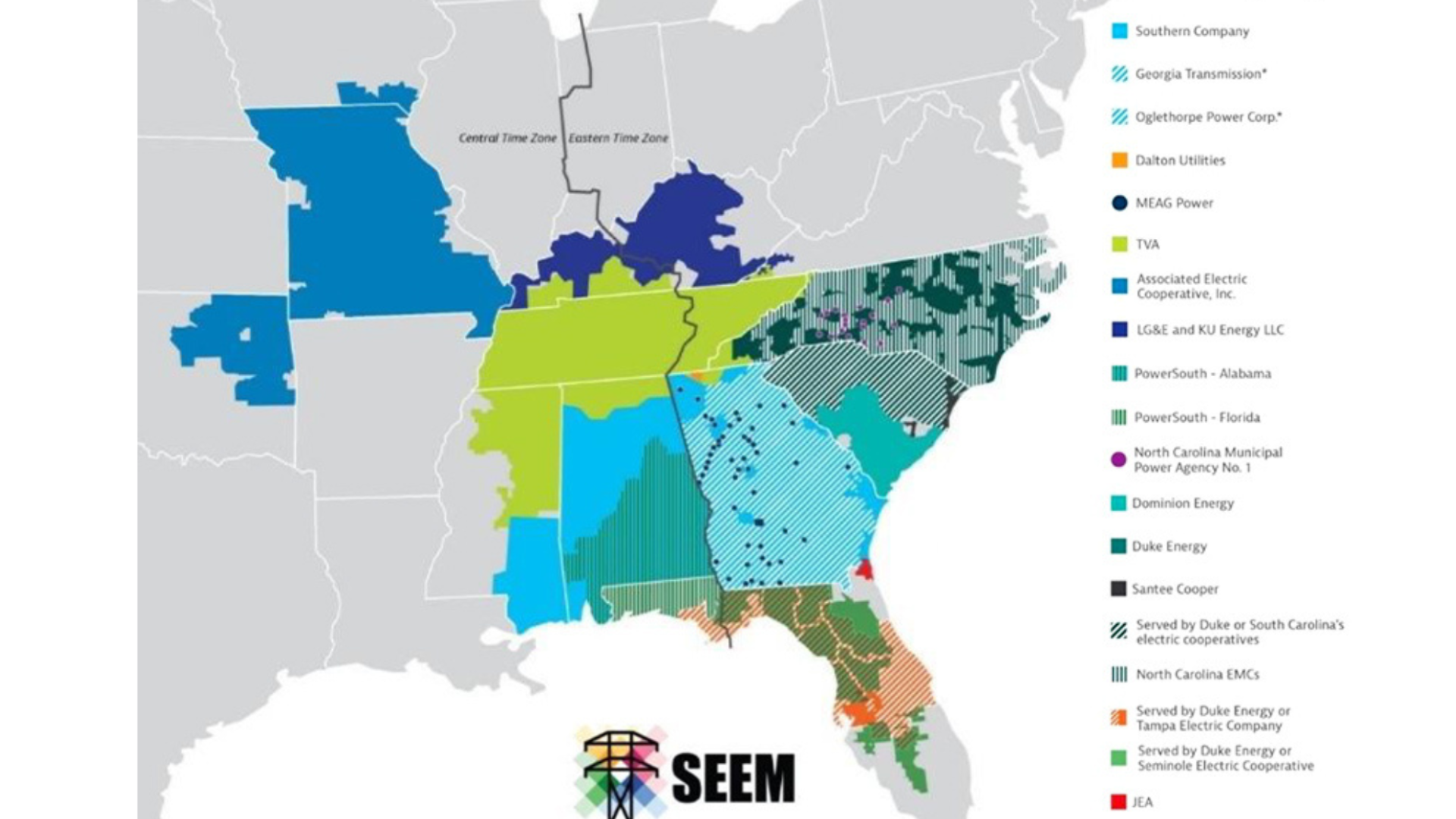

Born out of market reform talks in the Carolinas, SEEM was formally proposed in early 2021 and began operations the following November after a 2–2 deadlock at FERC allowed it to move forward “by operation of law.” Its members include some of the biggest players in the region, including Southern Company, TVA, Duke, LG&E/KU, Dominion South Carolina, PowerSouth, Santee Cooper, and AECI. Florida utilities joined in 2023.

The market operates on 15-minute bilateral trades, with buyers and sellers “splitting the difference” on price. SEEM was pitched as a way to save roughly $40 million per year for customers across the Southeast. But three years later, that promise hasn’t materialized.

What the Numbers Say

Despite steady operation, SEEM’s volumes are tiny, averaging about 80,000 MWh per month - equivalent to the output of a 300–500 MW solar farm, or enough to power roughly 80,000 homes. That’s just 1–2% of all bilateral power trades in the region, with the rest still occurring outside of SEEM altogether.

The average price of trades hovers around $30/MWh, with an average bid/offer spread of about $9.50/MWh. In 2025, SEEM’s total gross savings were about $1 million per month—a figure that works out to about one cent per year in household savings. That’s nowhere near the promised $40 million per year. And ratepayers still don’t know how much our utilities are spending to operate SEEM, something RTOs like MISO or SPP regularly report.

Worse, SEEM activity drops when the grid is stressed - exactly when regional coordination is needed most. Multiple SEEM audit reports show that during cold snaps and high-demand time, liquidity collapses as sellers withdraw offers. Georgia Power even told regulators that SEEM has no impact on avoided costs under PURPA - meaning, to put it in economic terms, SEEM is irrelevant.

Governance Without Accountability

Unlike MISO or SPP, SEEM has no independent governance or public oversight. There are no state commissions or public stakeholder processes, no market monitor, and no equivalent to the Organization of MISO States (OMS), MISO Reliability Subcommittee (RSC), or MISO’s Entergy Regional State Committee (ERSC - which we discuss in greater detail in another blog post). Membership is restricted to load-serving entities, ensuring that utilities maintain full control.

In short, SEEM is a private club, not a public market.

The RTO Advantage: Billions, Not Pennies

Now, compare SEEM to organized markets like MISO and SPP. Both operate day-ahead and real-time markets with locational marginal pricing (LMP), transparent transmission planning, and state regulator participation.

- MISO delivers $3.1–$3.9 billion in annual savings, compared to SEEM’s roughly $12 million (at best).

- SPP provides $2.14 billion per year in savings across its footprint.

- MISO members like Entergy Louisiana report $79 million in annual net benefits, even after paying $32 million in administrative costs, or about 94 cents per customer per month.

- Cleco and Entergy Mississippi each documented hundreds of millions in savings since joining MISO, far exceeding expectations.

When stacked against that, SEEM’s “savings” don’t even register.

So as we cut the cake on SEEM’s third birthday, the takeaway is clear - SEEM may have been a useful experiment, but it’s not delivering meaningful value to customers or regulators. The Southeast deserves a competitive market with transparent planning and verifiable benefits for all stakeholders. The evidence favors RTO reforms that offer proven benefits like cost savings, reliability, and transparency - hallmarks of true market reform that SEEM does not adequately provide.

SREA recommends that state commissions and policymakers:

- Publicize MISO and SPP assessments that quantify RTO benefits.

- Open PSC dockets to evaluate SEEM’s actual performance.

- Invite independent experts like Potomac Economics to review and present findings publicly.

- Encourage broader participation in regional market discussions (the Louisiana PSC X-files need more transparency) to ensure accountability.