With snow still on the ground across the Southeast, major electric companies are breathing a sigh of relief that no major grid disruptions occurred due to Winter Storm Fern. It appears that the power outages experienced across states like Louisiana, Mississippi, and Tennessee were due to downed distribution power lines, not difficulty from power generation or transmission lines.

The Southeastern region of the country does not have a Regional Transmission Organization (RTO), so operational market data of power sales across the region are difficult to access. However, the available data suggests the region experienced extremely strained power demands. And not just during Fern.

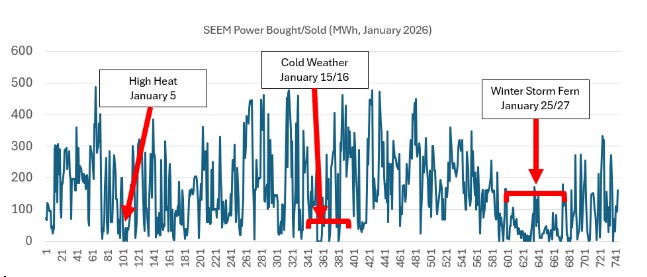

The Southeast Energy Exchange Market (SEEM) has been operational in the Southeast since 2021. When the region needs power the most, SEEM is not a reliable place to find bulk power. The last weeks of January were no exception.

Lights are On, Nobody is Home

In the past month, SEEM traded zero megawatt hours of power in 26 separate hourly occasions across all hours in the month. While Winter Storm Fern contributed to a number of those hours of zero trades, curiously, January 5 and 15 were also evidently tight days for SEEM. The early part of the month had extreme heat, with much of the Southeast basking in the unseasonably warm 70-degree-plus weather.

SEEM operates on a buyer and seller, bilateral basis. Sellers create ‘offers’ of energy on a 15 minute basis, at a voluntary volume, and price. Buyers submit ‘bids,’ or requests for power, on a voluntary price and volume basis, too. If an offer is below a bid, the two can match, and power can flow. If offers are too high, or bids too low, no matches occur.

As power demand increases, and supply dwindles, power prices rise. Trades that occurred through Winter Storm Fern frequently reached prices of over $200/MWh, peaking at an average $550/MWh at 4AM on January 27.

For the entire month, some 116,271 MWh were sold across the Southeast using SEEM at an average price of $57.44/MWh, for a total cost of $6,678,606.

SEEM self-reports a “benefit” value. For January, this value was reported as $2,430,544 - a record month for benefits. It is unclear how this number is created or accounted for. In some previous months with sales greater than January 2026, gross benefits reported were less than half than currently reported. For instance, September 2025 sales reached 123,648 MWh, but gross benefits were only accounted for as $738,379 - or less than a third of January 2026. Some discussions around SEEM have explained how the benefits are split evenly between the buyers and sellers. Due to the sheer volume of power sold across the Southeast, SEEM’s benefits likely show no impact on the end customers’ bills. To our knowledge, no state public service commission has investigated SEEM’s value.

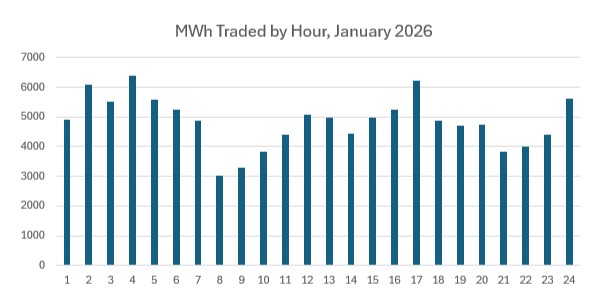

SEEM has often been touted as a way to help sell clean energy resources across the Southeast. However, for January 2026, most of the sales occurred during nighttime hours, when solar power generation is not generating.

Since SEEM’s inception, the market auditor has noted several times that the market platform often sees no power sales during times of system stress. SEEM’s market auditor, Potomac Economics, has previously stated:

“Activity was relatively steady with some variation across the month but with an exceptional three-day period with extreme cold weather starting December 24. During that period there was a notable decline in supply offers, causing transactions decline.”

— SEEM Audit Report, December 2022

“It does not appear, however, that participants look to the SEEM in extreme load events.”

— SEEM Audit Report, January 2024

“We had noticed in previous months liquidity declining during periods of high demand driven by extreme weather.”

— SEEM Audit Report, August 2024

“…offers tend to decline during higher demand periods…”

— SEEM Audit Report, October 2024

SEEM: An Evolutionary Step?

Winter Storm Fern did not expose a generation or transmission failure in the Southeast. But it did underscore the limitations of relying on a thin, voluntary bilateral market to provide meaningful support during periods of system stress. Yes, SEEM functioned as it was designed, matching willing buyers and sellers when price and availability aligned. Yet the record shows that when demand is highest and supply is tight, liquidity declines, offers disappear, and the market often goes quiet.

That pattern is not an anomaly. It is a recurring feature noted by SEEM’s own market auditor year after year. Zero-trade hours during extreme weather are not a sign of resilience; they are a signal that participants do not view SEEM as a dependable tool for managing reliability risk. High prices during the few hours when trades do occur may reflect scarcity, but scarcity pricing without consistent participation offers little assurance that power will be available when it is most needed.

If the goal is a regional market that actually performs during periods of system stress, the Southeast may need to reconsider whether a voluntary bilateral platform is sufficient.

An Energy Imbalance Market offers a fundamentally different model, one that relies on automated, real-time coordination across utilities rather than discretionary participation—and is explicitly designed to operate when conditions are tight. Without such a framework, the region risks continuing to rely on a market construct that fades precisely when coordination is most valuable.