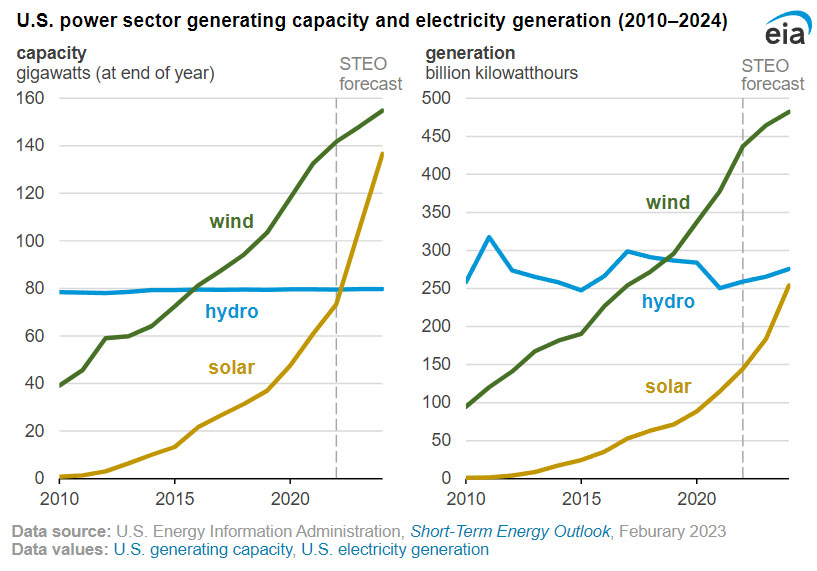

The electric industry in the United States has undergone a remarkable transformation over the past decade. In 2010, renewable energy accounted for only around 13% of electricity generation, with hydroelectric dams contributing the majority. Wind energy was on the rise but still trailed behind coal and natural gas, while solar power made up less than 1% of the energy mix nationwide. Fast forward to 2023, and approximately 14% of electricity was generated from wind and solar resources. Now, the Federal Energy Regulatory Commission (FERC), the top regulator of the U.S. bulk electric power system, is on the verge of implementing crucial reforms to grid planning that could significantly impact the reliability and affordability of our energy infrastructure. Depending on the final rule, a costly paradigm in grid planning could be avoided, and a more reliable and affordable energy future could be achieved.

When FERC issued Order 1000, their last major grid planning reform to accommodate emerging growth in renewable energy, partially driven by public policy needs, it recognized that without planning ahead, there could be significant technical, and economic challenges associated with the transition to wind and solar resources from legacy coal and natural gas. In hindsight, many industry insiders feel that Order 1000 changed little in grid planning, and this has only increased the technical challenges in the current day. Forecasts from the Energy Information Administration, considered by many to be conservative, indicate a substantial increase in renewable energy generation over the next decade, surpassing the growth experienced in the past.

Unlike previous shifts, the current transition to clean energy is driven not only by environmental considerations but also by economic factors such as decreasing costs and increasing consumer demand, as well as a desire for a more diverse fuel mix. In the Southeast, the cost of solar and energy storage has plummeted over the past decade, leading utilities like Southern Company and Tennessee Valley Authority to set clean energy goals for their territories. Additionally, corporate initiatives, such as Walmart’s drive to achieve zero emissions in global operations by 2040 is a major driver for procurement of clean energy in the region.

State and local governments are also playing a significant role in driving clean energy adoption. North Carolina, for example, has passed legislation requiring utilities to achieve a 70% reduction in CO2 emissions by 2030, while the City of New Orleans has committed to transitioning to 100% clean energy by 2050. Moreover, there is a surge in renewable energy projects in Arkansas, Louisiana, Texas and Mississippi stretching the limits of the current grid, with 42GWs of clean energy requesting connection in 2024 alone. And much attention has been focused in recent years on Louisiana’s efforts to establish offshore wind resources in the Gulf of Mexico in the coming decade.

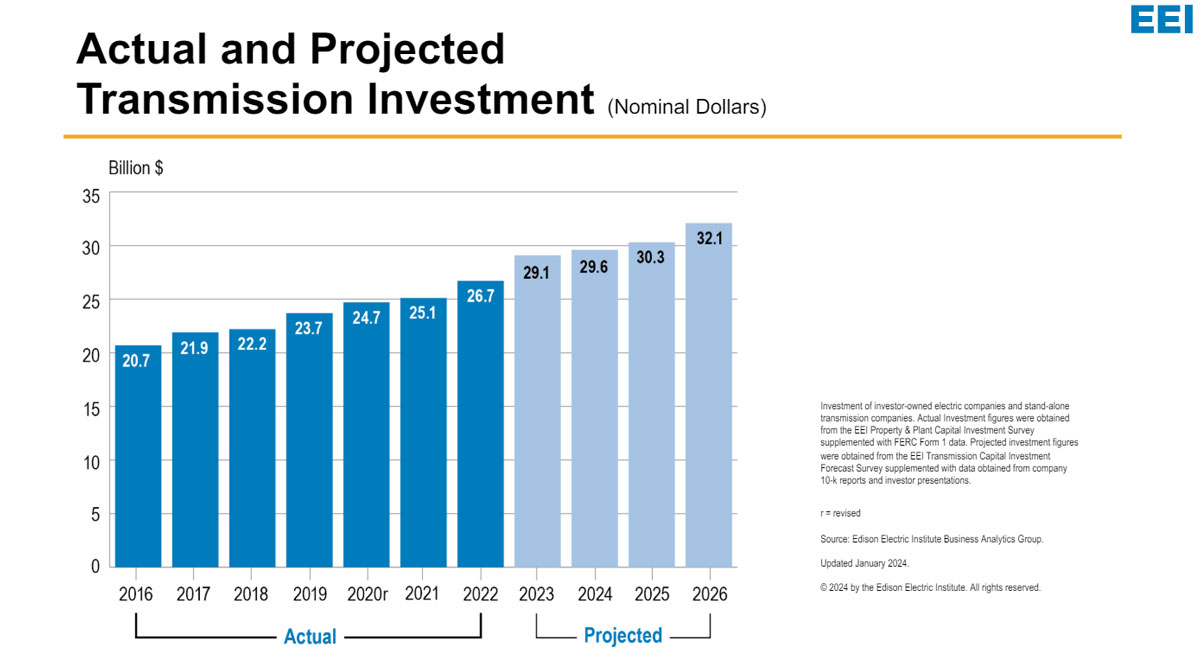

However, the current electric transmission system, designed primarily for coal and natural gas power plants, is ill-suited to accommodate newer technologies like wind and solar, as well as emerging trends such as electrification and onshoring of manufacturing. The inefficiencies of the outdated grid planning paradigm are evident in the rising costs of maintaining the system. Yearly proposed transmission investments in the United States have reached $20 billion, with little consideration for the long-term challenges and changes in technology, demand, and energy sources.

Regardless of how electricity is produced, we rely on the electric transmission system. This network consists of high voltage wires and substations that is analogous to an interstate highway system for electricity. The foresight is extremely limited with the investments made in this system that we are heavily reliant on. Transmission planners rarely look more than 5 years into the future when planning, which is roughly one tenth of the average 50-60 year lifespan of a transmission investment. During the lifespan of such an investment, power plants are decommissioned, new power resources begin operating, economic and population growth increases demand for electricity, and technology across many industries can change how all electricity consumers use energy. All these factors create technical challenges, that if not planned for with foresight, could lead to runaway costs in the future.

Source: Edison Electric Institute

Throughout the past few years FERC and state regulators have convened the Joint Federal-State Task Force on Electric Transmission to discuss many topics related to current and anticipated issues of grid reliability, affordability and the rising costs of transmission investments. Discussions with regulators, alongside a robust record of stakeholder comments have been distilled into a final rule expected from FERC this coming Monday May 13th. Many seasoned experts in the electric power industry expect it will create a sea change in how the grid is planned, and how investments are evaluated for their efficiency and cost effectiveness in addressing the challenges of the future.

Nearly two years ago FERC issued their Notice of Proposed Rulemaking with an appropriately ambitious title ‘Building for the Future Through Electric Regional Transmission Planning and Cost Allocation and Generator Interconnection’. This proposed rulemaking covers a lot of ground, but the ambitions of FERC are matched to a moment where inefficiencies in the electric industry related to grid planning, who pays for the infrastructure that’s planned, and how new generation resources are connected to the grid are on track to increase consumer rates across the country.

Transmission planning predominantly happens through utilities that develop yearly plans addressing short term reliability needs on their grids. Identified solutions can be fed into multi-state, or single state Regional Transmission Organizations (RTOs) that ensure these transmission solutions don’t harm other utilities’ grids. There’s 7 RTO’s across the country, and of those, only the Midcontinent Independent System Operator (MISO) and the Southwest Power Pool (SPP) have engaged in long term transmission planning beyond the 5 year planning horizon. In the Southeast, transmission planning has strictly followed this paradigm, both in the southern portion of MISO including Louisiana, Arkansas, Southeast Texas and Arkansas (MISO South), and in the Southeast Regional Transmission Planning (SERTP) group.

There is a large record of comments on FERC’s proposed rulemaking from 2022 (300+) that come from a diversity of parties. State and federal regulators, consumer rights groups, renewable energy companies, grid planning entities, electric utility companies and public interest organizations all provided comments not just on the proposed rulemaking, but also on the inefficiencies of current transmission planning in meeting the incoming challenges. Given the amount of valuable perspectives and insights provided, these comments play a healthy role in informing FERC’s decision on what to include in the final rule, within the bounds of their legal jurisdiction. There are a few main themes that made it into FERC proposed rulemaking that may provide insight into the final rule:

- Grid planners are not accounting for the future needs of the grid - While there are exceptions, most transmission planning in the U.S. only addresses near-term expected reliability issues looking 5 years into the future. Many electric utilities plan for generation needs on a state level, and even look out to 15 years into the future with multiple likely scenarios in their forecasts to account for a range of outcomes. But importantly, these utility plans do not offer regional transmission solutions to accommodate for a change in their generation resource portfolio. FERC’s proposed rulemaking requires transmission planners consider four scenarios looking out to a minimum of 20 years. They also cite ‘seven’ factors as a minimum for inclusion, including state, federal and local laws affecting the generation resource mix, utility plans, power plant retirements, electrification, economics and fuel cost of resources, trends in interconnecting generation resources, and corporate commitments to resources that affect future supply and demand.

- Whether benefits of transmission are accounted for, is a challenge for getting it built - It’s more common across the U.S. for transmission planners to assess few, if any benefits of large transmission investments. This leads to a situation in which large investments are seen as a burden on consumers, where smaller piecemeal investments that add up to billions of dollars over time are seen by many regulators as just the cost of maintaining a reliable system. This becomes even harder when planning transmission regionally over multiple states, Decisionmakers may look at some benefits as a gain for one state, but not theirs for instance. A common set of metrics does not exist currently across the country and this paradigm has preserved a churn of piecemeal investments that add up over time. FERC looks to change this by providing a proposed set of 12 benefits that they consider valid for assessing the value of regional long term transmission investments. The ability of regional transmission to access lower cost resources, to provide resilience, deferred costs for new generation resources, increased competition and market liquidity are all benefits considered. Many of these benefits proposed came from transmission planners who submitted to FERC in the rulemaking that their usage of these benefits in their experience, while not widely used across the U.S., are tangible and important to consider for such large investments.

- Who pays? - The question of who pays for transmission investments that not only span, but also likely benefit multiple states can roughly be equated to going out to dinner, and splitting the tab. Discussions around this topic can be highly productive when state decision makers are involved and invested in regional transmission planning efforts - but when there is lack of engagement, the result can be no resulting regional transmission being planned or built, or even legal disputes about some states paying for others or vice versa. Typically the key decision makers on transmission investments in their states are state Public Service, or Public Utility Commissioners and in the case of the cities of Washington D.C. and New Orleans, the City Councils. For many multi-state regional transmission planners across the U.S. like MISO, PJM and SPP, there are organizations that set up for state and local regulators to cost allocation along with other issues, but there are gaps in much of the country in the Southeast and Western regions were there is little to no involvement from state regulators in transmission planning decisions. FERC’s proposal is to increase state decisionmaker engagement in the process of cost allocation. In addition they proposed to have a backstop cost allocation for regional projects in the case that state regulators have not been able to find consensus within a reasonable frame of time. This would help to ensure that regional transmission does not go unbuilt which can benefit consumers. Furthermore, it may provide an incentive for state regulators to prioritize their involvement in long term regional transmission planning efforts across the U.S.

Unequal Outcomes

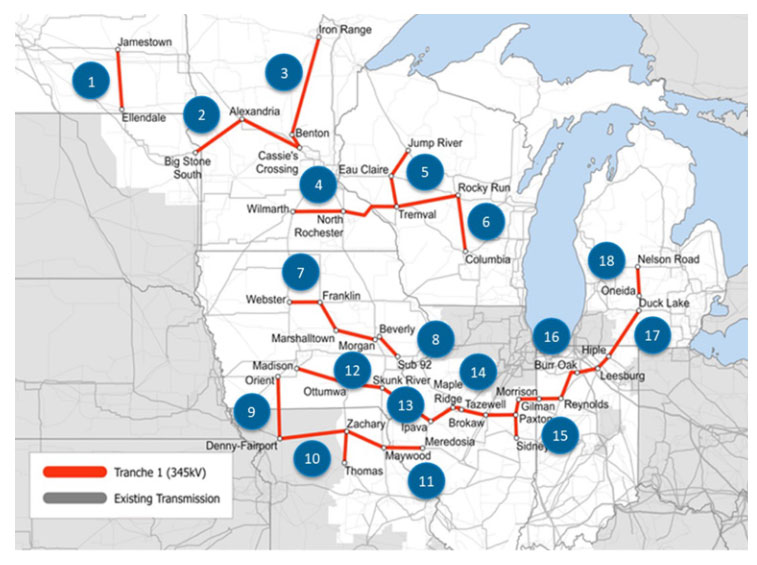

As mentioned, at least one transmission planner in the U.S. has been at the forefront of the kind of scenario based, multi-value transmission planning that FERC seeks to require through their expected order. MISO completed their Multi-Value Project effort in 2011, resulting in 17 regional transmission projects over 11 states in the north midwest, delivering up to $3B in benefits for every $1B spent on the total portfolio. Very recently, MISO completed ‘Tranche 1’ of their Long Range Transmission Plan (LRTP) again in the north midwest, resulting in 18 regional transmission projects over 11 states, delivering $2.6B in benefits for every $1B spent on the total portfolio. Tranche 1 is only the first part of a four phase effort for MISO to prepare the grid they oversee for a multitude of expected changes they have forecasted across a set of 3 probable scenarios. Currently MISO, state regulators from states they cover and a diverse array of stakeholders are engaged in discussions about ‘Tranche 2’ of the effort, again in the north midwest, and MISO expects to finish this effort in September of 2024.

Source: MISO MTEP21 Report Addendum: Long Range Transmission Planning Tranche 1 Executive Summary

Only half of MISO’s 15 state footprint stretching from North Dakota to Louisiana has been engaged in any kind of long term regional planning. Tranche 3 of MISO’s LRTP planning effort is slated to begin after the conclusion of Tranche 2, but the success of that effort hinges on Louisiana, the City of New Orleans, Texas, Arkansas and Mississippi to come to an agreement on cost allocation, likely with the rest of MISO’s 15 state footprint. There has never even been a planning effort of the scale of MISO’s MVP or LRTP in MISO South.

Historically, transmission planning more closely resembles what happens in the non-RTO SERTP regions yearly planning efforts to the east of MISO South. In the SERTP region, electric utilities plan for near term needs, 5 years into the future, consider only the benefit of one transmission project in alleviating another, and do not consider long term changes in the generation resource mix or demand. This is a problem, considering that projected growth in the region has become quite sizable and consumers largely want clean energy to fulfill that demand. That challenges fulfilling demand can change during the extreme weather events like recent Winter Storm Elliott, is another consideration. Building regionally has the potential to unlock resources outside of storm impacted areas, but planning like this is not considered currently in SERTP. Put simply, a grid planned in a piecemeal fashion has led to an over dependence on in-state generation planning decisions that may force a dependence on power plants that fail during extreme weather.

The challenges are great, but planning ahead, and doing so in a thoughtful manner is key to success. Hopefully the final rule issued by FERC supports best practices engaged in by grid planners like MISO that think long term and comprehensively about the needs of the future. In regions like the Southeast, where long-term regional planning has been absent, these reforms have the potential to catalyze the transition to ensure a reliable and affordable energy future regardless of preference for clean energy. By fostering collaboration among states, utilities, and other stakeholders, FERC's final rule could play an essential role in planning for a more resilient and efficient grid in the region, that meets the needs of the 21st century.