The Southeast’s electric grid is being asked to absorb historic levels of new demand, yet the regional planning process meant to prepare for that future is still modeling yesterday’s assumptions.

Utilities across the Southeast are publicly announcing gigawatts of new load tied to data centers, manufacturing, and electrification, while the Southeast Regional Transmission Planning (SERTP) process continues to rely on outdated load and generation data that does not add up.

When projected demand surges ahead but supply assumptions lag, or disappear entirely, the resulting plans are not just incomplete - they risk being obsolete. This disconnect underscores a fundamental problem in SERTP’s current approach: planning for a single, highly constrained future instead of evaluating a range of plausible outcomes through transparent, scenario-based analysis.

Load Growth Projections Underscore Scenario-Based Planning Needed

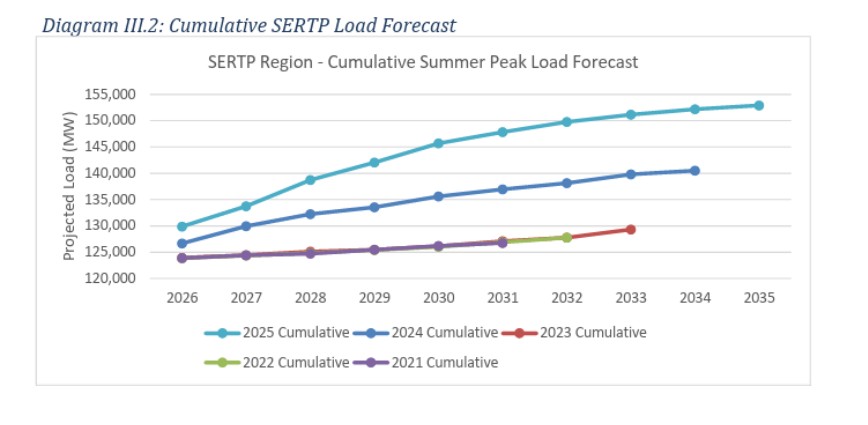

SERTP’s 10-year plan - discussed during the Q4 meeting in December 2025 - shows adding nearly 15 GW of new load between now and 2030, significantly more than forecasted just last year. At last year’s meetings, SREA noted that the load growth projections appeared low compared to public announcements by the utilities, and the utilities agreed at that meeting that the load projections provided in SERTP were inaccurate. This year, the same problem exists.

Individual SERTP utility announcements, plans, and forecasts, when added together, far exceed the 15 GW in the current SERTP plan. Consider:

- Georgia Power alone anticipates adding over 8 GW of new load by 2030

- LG&E/KU expects about 2 GW of new data center load

- TVA forecasts adding about 2-10 GW of new load within the next few years from the draft IRP

- Duke Energy's forecast includes over 3 GW of new load within the next five years.

Those four utilities alone represent somewhere between 15-23 GW of new load in the coming years, and do not include utilities like Alabama Power, PowerSouth, EMC’s in Georgia, AECI in Missouri, and other cooperative and municipal utilities across the Southeast.

Without reasonable or accurate forecasts, plans cannot keep up. Understandably, utilities are scrambling to better understand the new load growth phenomena across the region, making it difficult to settle on one set of data forecasts.

One way to resolve this forecasting problem is to create multiple models with different scenarios - something most of our utilities already do in their integrated resource planning processes. High, medium, and low demand forecasting is commonplace in Integrated Resource Plans (IRP) and other state regulatory proceedings, but this type of forecasting is entirely absent from the regionalized transmission planning processes in SERTP. Utilities and state regulators should be pushing to use scenario-based planning as a best practice in transmission planning.

Generation Addition Assumptions Don’t Add Up

SERTP utilities include generation additions and retirements in the 10-year planning horizon. While load growth projections are likely underestimating the true near-term demand, generation addition forecasts are similarly lacking. In some cases, SERTP utilities do not include known and likely power plant additions in the regional transmission planning data. For example, LG&E/KU showed no generation additions between now and 2035, despite receiving Kentucky Public Service Commission (PSC) approval for two new natural gas power plants this past October.

In other instances, utilities included proposed power plants that have yet to receive PSC approval. For instance, Southern Company included several new natural gas plants that the Georgia Public Service Commission (PSC) had yet to approve. Southern Company seems to have a much more expansive view of including generators in the SERTP data, with over 6 GW of new gas resources and almost 4 GW of batteries, plus solar, and nuclear uprates, but no coal retirements by 2035. Southern Company’s generation data assumptions appear much more robust than peer utilities in SERTP.

Duke Energy’s capacity expansion plans provided to the SERTP utilities appear to have an almost net zero set of additions for new generation by 2035, despite having plans of adding gigawatts of new gas plants, and efforts to add significant quantities of new renewable resources. Duke argues that new generation shouldn’t be included in the model without a signed Generator Interconnection Agreement (GIA). However, Duke also designates proxy generation, which for modeling purposes, effectively looks like a zero change to the model and bakes-in self-generation at a local site. Using a proxy generator seems to violate the requirement of having a signed GIA. No other SERTP utility uses proxy generators in the regional data, only Duke Energy.

TVA's data shows the company retiring about 3.4 GW of coal by 2029, and adds 3.6 GW of new natural gas power plants. The TVA data also includes 1.2 GW of new solar power, 300 MW of batteries, and a 200 MW solar+storage project, all by 2029. No other generation is added past 2029, not even the Clinch River 300 MW small modular reactor. It seems highly unlikely that TVA will stop building new generation in the 2030s. According to TVA, the company has nearly 10,000 MW of new generation under construction and in the pipeline. The draft TVA IRP shows additions of somewhere between 10 GW and 50 GW by 2035, far above the data included in the SERTP data.

It really seems that SERTP utilities are applying their own individual rules regarding whether or not to provide generation data to neighboring utilities. When asked about the high probability of significant load growth - while the data show nearly no new additional power plant capacity added, or a lack of significant capacity additions, and the concern of potential reliability problems in the model - stakeholders were told, “There's internal work being done,” that would resolve the discrepancies.

And while that may be true, SERTP’s purpose is to conduct a regional assessment for transmission planning, which cannot be done with haphazard data sharing.

So Why Does This Matter?

Imagine you’re invited to a potluck dinner. The host needs to know how many people will show up - or, to borrow from our current parlance, what’s the demand? But the host also needs to know who’s bringing dishes - i.e. who’s handling supply? If the host underestimates how many people will show up, while simultaneously conveying to the attendees an underestimated amount of food will be available, how would the dinner attendees respond? In a data-based model, the model won’t run properly and the results look fishy.

One way to fix these discrepancies is through scenario-based planning. Evaluating multiple levels of load growth, with various types of new generation additions to serve that new load, is what all the SERTP major utilities do in their IRP process.

The problem is, SERTP doesn’t look at multiple scenarios. It looks at a single, exceptionally flawed view of the future. That may be one reason the process has still never led to the development of a regional transmission project.

But, It’s Not All Bad News.

Southeast electric utilities recently announced $17.6 billion in new transmission upgrades, signaling a substantial commitment to modernizing the grid. The 2025 SERTP regional transmission plan includes:

- Around 465 projects totaling approximately $17.6 billion, including more than 1,150 miles of new transmission lines

- Over 2,830 miles of uprates (upgrades, reconductors, and rebuilds), and

- 33 transformer additions or replacements.

Southern Company highlighted nearly 500 miles of new high voltage transmission projects being planned in the near term. Southern used scenario-based planning to come up with these new transmission projects.

Duke Energy’s local transmission planning process, the Carolinas Transmission Planning Collaborative, also uses a local scenario-based transmission planning process, which should help unlock new areas for power generation. TVA has plans to develop a new “Integrated Transmission Plan” that pairs with its IRP. These individualized internal and local plans are certainly helpful and will be improvements over previous processes; however, they cannot replicate or replace true regional planning.

SERTP’s Q4 meeting drew strong participation, with more than 60 attendees online at peak and robust in-person engagement. The SERTP meeting also provided more information to stakeholders than what had been available in the past. Materials were posted ahead of the meeting, enabling stakeholders to develop questions and better prepare for the meeting itself. In fact, SERTP utilities have done a much better job now of setting out a clearer schedule for 2026, making it easier for stakeholders like SREA to plan for participating at meetings. These may seem like small wins, but they’re important for transparency and are greatly appreciated.

Looking ahead, regulators, utilities, and stakeholders will need to navigate trade-offs between longer planning horizons and forecast uncertainty. The process should continue to leverage scenario-based planning, transparent governance, and stakeholder engagement to ensure that the plan remains adaptable while signaling where attention is warranted.

The Southeast faces a dynamic mix of drivers: data center demand, expanded solar and battery storage capacity, commitments to new natural gas generation, and supply chain delays for critical equipment. With generation coming online, transmission needs must be in place to ensure timely delivery and cost-effective operation across the grid. As we enter a new year, the message is clear: decision-makers should prioritize proactive long-range transmission planning before rising demand outruns the grid. The case is not merely aspirational; it is economic and practical.